How to Set Up an LLC and EIN in Illinois

These days, everyone seems to be starting a business. For good reason, as many of us have the talents, skills, and ideas to create a viable business. Who wouldn’t want to have access to the control, freedom, and enormous value that all of that can unlock?

The problem however is that most people are unaware of when, where, or how to start. For some people, it’s writing out a business plan or marketing strategy. Others are inclined to hop right into it by selling their product or service immediately.

There are many different ways to organize your business. No matter what order of steps you take, building a legitimate company will sooner than later require that you register the business entity with your state. Most small businesses are organized as a limited liability company (LLC).

We created this guide to help Illinois-based business owners and entrepreneurs learn what an LLC is, how to establish one, and the benefits.

What is an LLC?

A limited liability company is a business structure that establishes a company name and how its operations are regulated by the law. As the name suggests, LLCs are also intended to protect owners’ and operators’ from being impacted personally by company matters such as litigation, debt, and other liabilities.

Why You Should Organize an LLC

Registering your business as an LLC is the first step to building a legitimate company. Since you are putting in money, time, and resources, you should reap the legal or financial benefits, as well as be protected from threats such as lawsuits.

Business Banking and Credit

Separating business and personal income and expenses will be mandatory if your business is to succeed long term. Many small business owners fail to properly organize their company’s finances and later find themselves in a bind that is hard or even impossible to come back from. Opening a business checking and savings account will help prevent such an outcome.

Business banking also presents access to new forms of capital such as business loans, credit cards, and lines of credit. Borrowing as an LLC has no impact on your personal credit score or report past the application process. Business transactions made with business credit will stick with the business, assuming that balances and payments are managed properly.

Want additional information on business banking and credit? Contact Lashley Financial Solutions

Government Grants and Loans

The Small Business Association (SBA) is a government entity that assists small businesses with starting and expanding. Having an established LLC grants access to funding that is backed by the SBA, making it easier to obtain than traditional bank loans. SBA loans range from $500 to $5 million and can be used for operating or buying new assets.

Taxes

Each year we are met with the burden of paying taxes on hard-earned individual income. However, tax liabilities are generally reduced for LLCs. Individuals are expected to earn income, pay taxes, and have what is left over to live with. Businesses on the other hand pay taxes only on the income that is leftover after expenses, or “write offs”. To use a real life example, Amazon made headlines in 2018 for paying $0 in federal income tax on $11 billion in profits. Having your LLC’s books in a good place will put you in a good position to not lose during tax season.

Want additional information on tax planning and preparing? Contact Badu Tax Services

How to Organize an LLC in Illinois

The Secretary of State is responsible for managing business registrations in most states. Here are the steps that you can follow today to establish your LLC in Illinois.

Step 1 - Decide on a Company Name

The name of your LLC must be distinguished, or different from existing companies. Illinois also requires that the name includes the words LLC, L.L.C. or Limited Liability Company.

This database is available for you to search to determine whether or not a name is available.

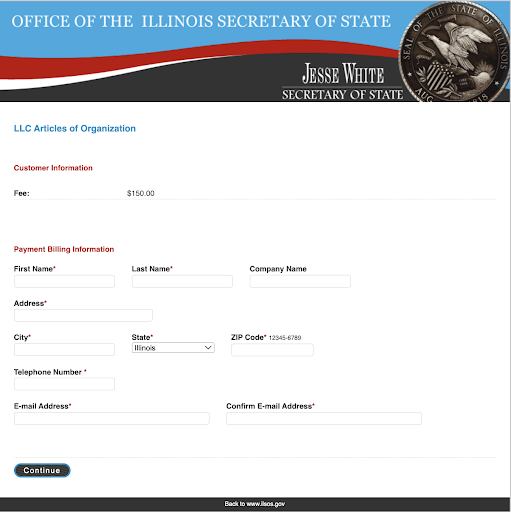

Note that the filing fee is currently $150 for a standard LLC, plus additional fees for expediting and processing electronic payment.

Step 2 - Go to ILSOS.gov

Read the instructions about filing articles of organization, and click File at the bottom.

Acknowledge that you are establishing a standard, or single entity LLC rather than a series. A series will be better suited for businesses that have a complex structure, such as multiple sub-companies.

Indicate that you understand and agree with the below provisions.

Type, proofread, and submit the desired name.

The Principal Place of business is the commercial or residential location that your business operates from virtually or in-person.

The registered agent is a person or entity that acts on behalf of the company. Usually this will be yourself, another owner of the business, or an attorney.

Managers are owners, agents, or principals of the business who have ownership.

The next step is a straightforward attestation that the submission is accurate and truthful. Feel free to keep the name and addresses consistent with the previous submissions.

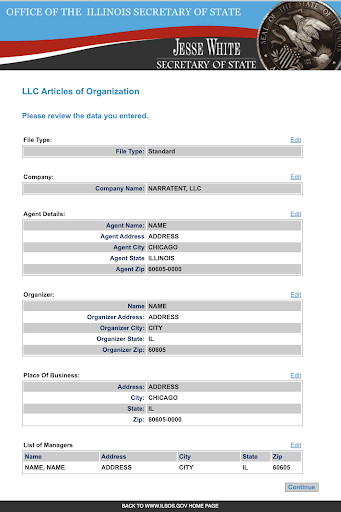

Double check that the information within each section is accurate and complete.

Decide whether you will need expedited or standard service based on estimated turnaround times.

Now you are all set on information and ready to submit payment for processing.

And yes, that is all there is to it!

Once your submission is reviewed and filed, a print out of the articles of organization will arrive in the mail. Meanwhile you can also search the LLC database to see the status once filed.

Keep in mind there are other business structures including sole proprietorship, partnership, corporation, and nonprofits that all have pros and cons. As business needs evolve, consider becoming familiar with the different forms of business registration.

Generating an EIN

EIN stands for employer identification number, the equivalent of a social security number for businesses. EINs are used to verify the status of a business entity and how the company is taxed. Once an LLC is filed, the EIN can be generated immediately from the Internal Revenue Service (IRS).